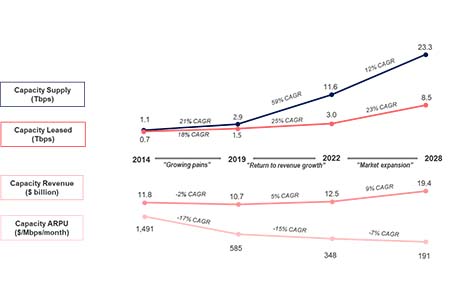

The satellite communications market will grow to $19.4 billion by 2028, according to the Satellite Connectivity and Video Markets Survey report from Euroconsult, a leading global authority on space and satellite-based applications. Following a decline that began in 2014, Euroconsult’s research forecasts a return to revenue growth beginning in 2020, driven by demand for broadband applications, including rural connectivity, in-flight communications, as well as cellular backhaul.

The satellite communications market will grow to $19.4 billion by 2028, according to the Satellite Connectivity and Video Markets Survey report from Euroconsult, a leading global authority on space and satellite-based applications. Following a decline that began in 2014, Euroconsult’s research forecasts a return to revenue growth beginning in 2020, driven by demand for broadband applications, including rural connectivity, in-flight communications, as well as cellular backhaul.

“A confluence of market and technology forces have contributed to a period of great turbulence in the satellite industry,” said Nathan de Ruiter, Managing Director of Euroconsult Canada and Editor of the Research. Traffic over satellite continued to increase to nearly 1.3 Tbps in 2018, however, this did not drive revenue growth because of reductions in capacity pricing across all regions. “While headwinds continue to persist in 2019, it is encouraging that our findings point to a return to revenue growth next year”.

The satellite communications market is heading towards an inflection point in 2021, where wholesale revenue for voice & data applications will equal traditional broadcast revenues. Post 2022, the satcom market should enter an era of market expansion, driven by anticipated demand elasticity in price-sensitive verticals, such as consumer broadband access, Wi-Fi hotspots, inflight connectivity and cellular backhaul.

The research examines the forces impacting the satellite industry in recent years including changes to business models, user requirements, technologies and the competitive landscape. New to this year’s edition of the Satellite Connectivity and Video Markets Survey (previously named Satellite Communications & Broadcasting Markets Survey), the report differentiates between traffic flowing over geostationary (GEO) satellites versus Low Earth Orbit (LEO) constellations and it includes market intelligence on capacity pricing and impact on revenues for each class of service.

Add Comment