The Satcom 3.0 transition phase has begun in 2020 with many expectations from top metrics this year, which may have a maximum impact on the Satcom industry.

The Satcom 3.0 transition phase has begun in 2020 with many expectations from top metrics this year, which may have a maximum impact on the Satcom industry.

Some trends as voiced last year are clear – the wholesale lease versus service debate has been put to rest in a telecommunication economy impacted by three- to four-year tech cycles and the urgency to reach end-customers with increasing video consumption.

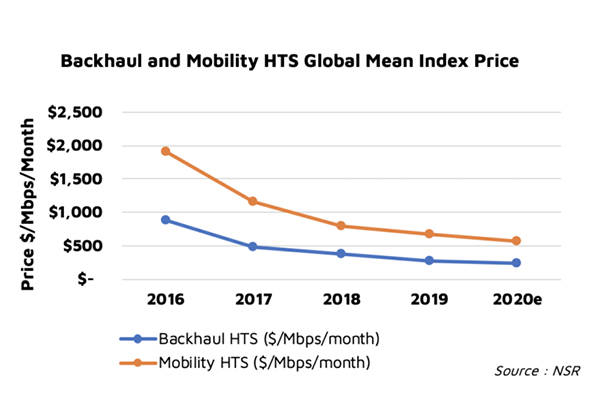

Capacity pricing plummeted below $500/Mbps/month, and as supply acceleration peaks in 2021-22, companies are attracting private buyouts (Inmarsat and Asiasat), with consolidation towards equipment vendors (ST acquiring Newtec) to identify new strategies to scale.

While wholesale lease revenue is expected to stagnate or decline, service revenue will see a significant expansion in 2020, adding gains from both operators and service providers, on the back of strong mobility, backhaul and consumer take-up.

Video hotspots continue to reel under pricing pressure, and new IP-based offerings are key to renewing growth in this market. Finally, it is impossible to purely look at backlog to ascertain the stability of a Satcom operator; more metrics including fleet-wide unit economics and forecast, along with subscription possibilities, are needed.

Supply metrics remain consistent – large growth in HTS, with strategies panning region or mission-specific small GEOs (~20-25 Gbps), mid to large application-specific (50-200 Gbps), VHTS for truly low unit economics, and then finally constellations for ubiquitous coverage.

These accelerated supply gains must be met with accelerated fill rates and/or revenues to close business models in the first 5-7 years and tackling competition with captive positions is critical in ABC (aero-backhaul-consumer) growth segments. Pricing curves will follow supply costs, and GEO-HTS are expected to surge on this basis of finding customers in the next 3-4 years.

The C-band debate on net proceeds to operators surges on, albeit with a 300 MHz spectrum repurposing decision by FCC along with a public auction. Intelsat’s debt payoff or paydown largely hangs towards a favourable outcome of this decision.

The C-band debate on net proceeds to operators surges on, albeit with a 300 MHz spectrum repurposing decision by FCC along with a public auction. Intelsat’s debt payoff or paydown largely hangs towards a favourable outcome of this decision.

Technology is evolving much faster than a typical 15-year satellite leasing period, thus floor pricing keeps dropping lower with every year passing by. This will sustain a period of high profitability for new assets, only to cushion losses by +10-year old satellites.

Market addressability also increases in critical ABC segments as costs decline. Finally, the critical focus will be placed on EBITDA margins moving forward, as the industry looks to recover CAPEX cost for new projects.

This year and onwards will see major CAPEX investments from SES, Inmarsat, and Eutelsat in largely Aero and Broadband bets. Pre-launch contracts towards Viasat-3 & Jupiter-3 and Telesat’s decision on constellation will be closely monitored as well.

M&A and privatisation are expected to continue to fight competition, and the industry will (slowly) consolidate across ecosystem layers. All eyes are on unit economics going forward, whether it’s CAPEX costs for new satellites or subscription models.

Satcom 3.0 demands a future-proof fleet strategy and a sound distribution model, thus closely watch out for decisions made in this space. Building fleets with timelines closer to tech cycles will also be key (flexible payloads), but growth hacking in 2021 is likely to adversely impact short-term profitability. One thing is clear: risk-taking (and likely CAPEX spending) will be essential to effectively compete in the Satcom 3.0 era.

Add Comment