A new report from Euroconsult showed that that 11 new Fixed Satellite Services (FSS) providers have emerged over the last five years including two in 2018.

A new report from Euroconsult showed that that 11 new Fixed Satellite Services (FSS) providers have emerged over the last five years including two in 2018.

Many of these companies are state-owned national operators. Twelve new satellite operators are planning to enter the FSS geostationary (GEO) market by the early to mid 2020s.

Included in these twelve operators, are three with plans for small GEO satellites, which may indicate a new trend in the FSS industry facilitated in part by digital payloads, electric propulsion, and lower launch costs.

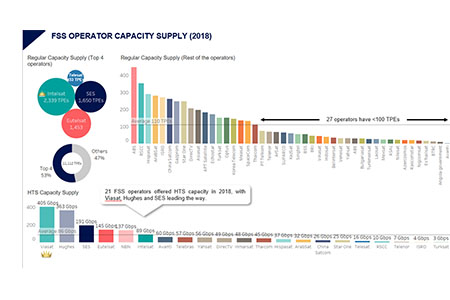

The research demonstrated that the market structure of the FSS industry remains concentrated at the top with growing fragmentation at the bottom. The top four operators (SES, Intelsat, Eutelsat and Telesat) today represent approximately 60% of the industry’s revenue, a share that has decreased in recent years. Five years ago, they combined for 64% of total revenue.

The landscape behind the top five is rapidly evolving with three new companies joining the top ten in the past five years. These include YahSat, China Satcom, and ISRO.

Commenting on the report, Senior Consultant at Euroconsult Dimitri Buchs said: “Our analysis shows that FSS operators are exploring new strategies to address the evolving market. We noted that several satellite operators are transitioning from sole wholesale bandwidth suppliers to managed services providers. This helps them increase the value they bring to their customers and minimise commodity pricing. Some satellite operators, such as SES, are even pushing towards end-to-end network solutions for selected markets and/or customers.”

To meet data-driven market demand, the survey reported that many FSS operators are shifting their investments from traditional satellites to High Throughput Satellites (HTS). The number of FSS operators with an HTS payload doubled between 2014 and 2019, growing from 12 to 24 with the total HTS supply expected to reach more than two terabits per second by the end of 2019.

The market survey discussed the projects which have progressed including OneWeb, Telesat LEO and SpaceX’s Starlink constellation, as well as other projects that could materialise in the longer term such as Amazon’s Project Kuiper, and Chinese projects Hongyan and Hongyun.

Market forces continue to impact the FSS industry in 2019. In 2014 at the market peak, the overall size of the industry reached $12.3 billion. In 2018, the industry had an overall size of $11.5 billion, with revenues down 0.4% year-over-year.

Commenting on the FSS revenue, Dimitri Buchs added: “Our forecast is for FSS revenues to continue their downward trend in 2019. However, despite the overall environment, the market structure of the FSS industry has remained relatively stable, with the four top operators dominating the market. New growth segments, led by in-flight connectivity, maritime connectivity, and general broadband access, continue to drive demand for HTS capacity, and global interest in universal broadband access offers significant upside potential.”

Add Comment