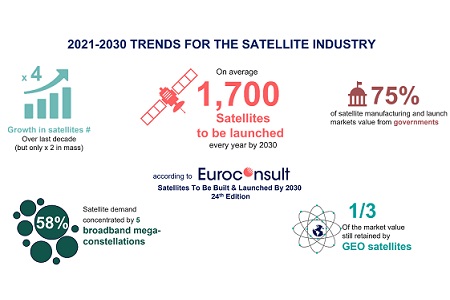

Satellite market forecast anticipates 17,000 satellites to be launched in the next 10 years representing a fourfold increase over the past decade, reflecting structural changes in the whole space ecosystem and a limited short-term impact of the pandemic, according to a report titled Satellites to be Built & Launched by Euroconsult.

The new edition of Euroconsult’s satellite market forecast assessed individually about 170 constellation projects, of which 110 are from commercial companies. While OneWeb, Starlink, Gwo Wang, Kuiper and Lightspeed will represent 58% of the 17,000 satellites to be launched, they will account for only 10% of the satellite manufacturing and launch revenues of the space industry. The report identifies two reasons combining to explain this difference: economies of scale in satellite manufacturing and a strong decrease in launch prices.

Despite a multiplication of commercial constellation projects, only a few place satellite manufacturing contracts, generally with established players. Excluding a few large deals for large constellations and new communication satellites in geostationary orbit (GEO), global competition remains limited for satellite manufacturing. Satellite demand from the governments fuels the competition between local suppliers with still limited opportunities for them to expand internationally (because of national preference in every country where a space industry is established).

Speaking about the analysis, Maxime Puteaux, Principal Advisor at Euroconsult and Editor of the report, said: “The satellite sector no longer revolves around the axis of New Space entrants challenging established legacy players. Instead, it has now shifted towards speed, and the ability to rapidly provide commercial services from satellite constellations, be it for broadband and/or narrowband communications (e.g. IOT) or global and real-time observation of the Earth. New Space is no longer the driving force in the industry. It’s all about Fast Space now.”

Despite new business models from new commercial players in space, governments still represent three-quarters of the revenues of the space industry over the decade, i.e. $240bn. Likewise, incumbent satellite manufacturers continue to dominate the market, with four of them capturing half of the market in the past decade for a value of $87bn.

Add Comment