According to Euroconsult’s newly released research, Prospects for the Small Satellite Market, the market for small satellite (smallsat) manufacturing and launch will grow from $12.6bn in 2009-2018 to $42.8bn in the coming decade from 2019-2028, nearly quadrupling in size.

While the growth is led by large constellations such as OneWeb, SpaceX’s Starlink and Amazon’s Project Kuiper, the findings show that the smallsat industry is diverse, with demand from a variety of operators, start-ups, universities, and countries.

With data on the period from 2009-2018 for historical trends and 2019-2028 for forecasts, Prospects for the Small Satellite Market is a comprehensive resource for assessment of both current and future trends. It quantifies the changing landscape in the context of market drivers and their impact.

Commenting on the findings, Alexandre Najjar, Euroconsult Consultant and Editor of the report said: “The smallsat market continues to grow in significance for investors, manufacturers, the supply chain, and a range of other stakeholders.

“Our report is an essential tool for strategic planning with an unbiased analysis of current and future trends. It provides tangible evidence of the increasing demand for smaller and more capable spacecraft.”

The report found that in 2017 and 2018 there was 93% in the number of smallsats launched compared to 2014-2016.

8,600 smallsats will be launched in the next decade, at an average of 835 each year by 2023, growing to an average of 880 per year by 2028.

Constellations account for 83% of the satellites to be launched by 2028, the report found.

The number of smallsats to launch in the next ten years increased by 22% over the forecast in the last edition of this report.

Satellites in the 250-500-kilogram mass range represented 6% of the total number of satellites launched between 2009-2018 but will grow to 18% of the satellites launched in the next ten years.

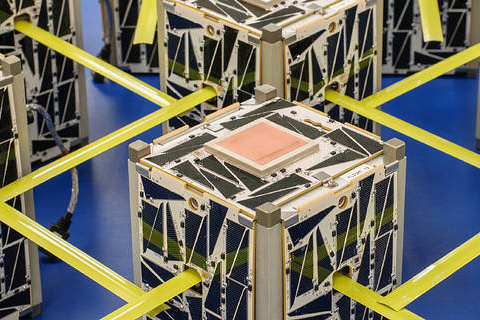

Smallsats under ten kilograms, such as 3U CubeSats, will account for 28% of the smallsats launched in the next decade, but only 2% of the total market value.

Broadband satellite communication should witness the strongest growth with close to 4,200 satellites expected from 2019 to 2028.

Add Comment