The fixed-satellite service (FSS) capacity pricing is decreasing at a rapid rate due to services supported by next-generation geostationary (GEO) and non-geostationary orbit (NGSO) HTS systems such as Starlink undercutting the market, according to the latest edition of the FSS Capacity Pricing Trends report by Euroconsult.

The fixed-satellite service (FSS) capacity pricing is decreasing at a rapid rate due to services supported by next-generation geostationary (GEO) and non-geostationary orbit (NGSO) HTS systems such as Starlink undercutting the market, according to the latest edition of the FSS Capacity Pricing Trends report by Euroconsult.

At the highest industry level, FSS capacity pricing continued to erode in 2022, as the global volume of leased and used capacity increased at a rate that far outpaced the growth in satellite operator revenues.

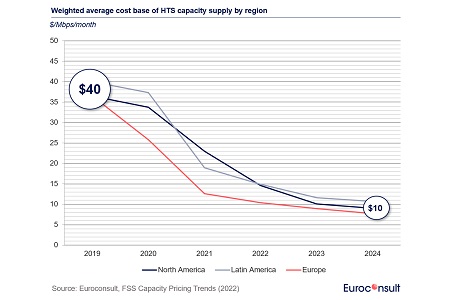

Over the past five years, global averages for capacity pricing in video and data markets have fallen by approximately -20% (-4% CAGR) and -67% (-20% CAGR), respectively. For data markets, Euroconsult’s newly introduced forecasts anticipate this general trend continuing over the next two years with annual declines of -8% to -15% projected across most regions. For most data and broadband markets, this sharp downward trend has brought significant disruptions to the industry, largely due to the abundance and ever-falling cost base of new HTS capacity which supports aggressive pricing levels.

The influence of both GEO-HTS and NGSO-HTS capacity is expanding both regionally and vertically in terms of market reach. However, while the coverage of NGSO broadband constellations is inherently near-global, regional HTS capacity pricing dislocations are likely to become further pronounced over the next several years, notably in regions such as Russia and South Asia where national regulatory and import substitution policies are likely to limit near-term impacts of new, lower-cost HTS capacity supply.

The dynamics laid out in the report highlight drastic changes for the industry, which had previously thrived for decades on revenue-maximisation strategies underpinned by relatively limited competition and a well-maintained equilibrium between supply and demand that often contributed to situations of capacity scarcity. The scale, compelling value and capability offered by Starlink and other next-generation GEO-HTS systems and NGSO-HTS constellations may mark the onset of a structural shift away from the traditional model of wholesale leasing of dedicated (uncontended) bandwidth by service providers towards the resale of best-effort (contended) managed broadband offerings supplemented by value-added service add-ons.

Compared to traditional satellite broadband services, the low latency, high-data rates, and high priority data allowances supported by next-generation NGSO-HTS capacity, alongside its compelling pricing and high value for money, have been the biggest cause for waves in the market. To illustrate, based on a global analysis of over 1,000 consumer and business satellite broadband service plans, Starlink’s equivalent price per GB of priority data was found to be 10 to 50 times lower than the vast majority of competing legacy offerings on the market today, and at a similar or lower total monthly cost.

Add Comment