Novaspace, the result of a merger between Euroconsult and SpaceTec Partners, has forecasted a significant increase of 160% in the global launch rate for defence and dual-use satellites over the next decade.

Novaspace, the result of a merger between Euroconsult and SpaceTec Partners, has forecasted a significant increase of 160% in the global launch rate for defence and dual-use satellites over the next decade.

Novaspace estimates that worldwide government expenditures in space defence and security reached over $58bn, a historic high. Government expenditures are driven by an increasingly fragmented geopolitical context, the growing rivalry between the US, China and Russia, as well as the growing integration of space-based services in conventional military forces on land, air and sea.

The new data is part of Novaspace’s Space Defense and Security report (first edition), an in-depth analysis of current and emerging space defence trends, dynamics and demand drivers, which offers vital insights into the space defence and security landscape, and showcases the significant contributions of leading nations.

Four countries emerged as frontrunners in 2023, each with investments exceeding $1bn. The United States led with $38.9bn, followed by China with $8.8bn, Russia with $2.6bn, and France at $1.3bn. Japan, the United Kingdom, the European Union and Germany also made substantial investments, each surpassing $500m.

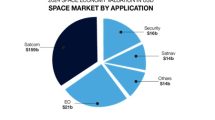

Of the $58bn allocated in total by governments, an estimated $40bn was contracted to industry for the provision of crucial space defence and security capabilities. These include the manufacturing and launch of government satellites, the provision of user terminals, the commercial operation of government systems, and the delivery of commercial space defence and security products, data, and services to defence organisations.

A majority of funding is for the manufacture of government systems as countries seek to maintain control over proprietary systems for sovereignty reasons, while the acquisition of commercial data to augment or complement government-owned systems is identified as a growing trend, particularly in the United States. Procurement of services remains more limited as most defence organisations carry out data analytics in-house, though this is also showing early signs of change.

The report highlights industry revenues across four value chain segments totalling $40.2bn. These include the manufacture and launch of defence and dual-use satellites ($24bn), provision of user terminals ($3.3bn), operation of government systems and sale of data ($10.2bn), and provision of managed and value-added services ($2.7bn).

In 2023, some 107 defence and dual-use satellites were launched by 17 governments, a 40% increase from the previous year. The US logged 44 launches, followed by China (30) and Russia (11). Other countries combined launched a total of 22 defence and dual-use satellites. The top capability domains were Intelligence, Surveillance and Reconnaissance, (29), Secured Satellite Communications (24), Signal Intelligence (23), and Technology Demonstrators (16).

Novaspace’s report forecasts an on-going and substantial increase in the number of new defence satellites over the next decade, with over 2,600 launches projected, an increase primarily driven by the need for system architectures to enhance the resilience of space-based services and, to a lesser extent, by the growing number of countries investing in space defence and security.

“An increasingly fragmented global geopolitical context is a major driver of space defence and security expenditures,” said Principal Advisor Simon Seminari, editor of the report. “This is marked by high-intensity conflicts in Ukraine and the Middle East as well as contained tensions in the South China Sea, the Pacific, the Indian subcontinent, and Africa. “As space becomes more contested, congested and competitive, countries worldwide are bolstering their defence readiness. Space is integral to modern warfare, with militaries relying on space-based capabilities for battlefield awareness, navigation in low visibility conditions, and secured connectivity in hostile environments,” he added.

Add Comment