Eutelsat Ghassan Murat, Regional Vice-President for MENA

Eutelsat’s broadcast activity, which spans across direct-to-home broadcasting and content distribution to terrestrial headends, remains resilient thanks to several factors. These include the fact that we have seen a steady increase of digital and HD channels in progression of 16% since last year, our geographic exposure with emerging markets accounts for approximately 40% of revenues, and our business model is predominantly DTH and the most resilient sub-vertical, compared for example with cable headend feeding.

The bulk of the impact of this crisis stems from mobile connectivity. However, Eutelsat’s exposure to this segment remains limited, accounting for 5% of its revenues. While maritime mobility is holding up well and continues to underpin demand, the crisis and its subsequent impact on travel has seen an immediate and severe impact on demand for aero mobility. The timing of recovery in the aero market remains uncertain, but Eutelsat is confident that it will see a resumption of growth in the medium term, with the restart of air travel and the ever-increasing demand for high-quality internet access everywhere by passengers.

The Covid-19 crisis has indeed accelerated the need for high quality, reliable broadband. Evolving technology with geostationary satellites such as EUTELSAT KONNECT and EUTELSAT KONNECT VHTS means satellite connectivity can now provide a reliable, accessible and cost-effective solution for the millions of businesses and individuals throughout the world. In this last fiscal year, we made significant headway in our fixed broadband strategy, laying the final foundations for acceleration in growth from this year onwards.

We also made a significant strategic step, gaining a foothold in the LEO opportunity through our investment in OneWeb. OneWeb will become our main growth engine outside our broadcast and broadband applications, as we continue to maximise cash-flow extraction from our highly profitable heritage business and grow our fixed broadband vertical, leveraging our geostationary assets.

Avanti Communications Kyle Whitehill, CEO

There are still 3bn people in the world today who are not connected. At Avanti Communications, we are passionate about changing that. Even at the height of the Covid-19 pandemic, when the digital divide felt at its strongest, we identified opportunities to reach even more individuals, businesses and communities in hard-to-reach locations who have never before been connected to the rest of the world, but who may feel the greatest benefit.

We already know that global demand for data outstrips supply, leaving many excluded. In Africa, this is even more exaggerated, offering huge scope for future growth in the coming years. This is especially true in sub-Saharan Africa, where rural network expansion is desperately needed. As a major HTS company in Africa, Avanti is poised to unlock this. Across our HYLAS fleet, more than 70% of our coverage is over Africa. To help power growth, we have also committed 75% of our total investment to connecting the continent.

But while significant progress has been made over the past 30 years in connecting rural communities, this remains a huge challenge for even the largest mobile network operators (MNOs), due to limited terrestrial networks. By working in close partnership, we have been able to help these partners to expand their networks. For example, our recent partnership with Clear Blue Technologies is expected to deliver life-enhancing coverage to the 400m people living in remote areas within three to five years.

This is important, as connectivity is a vital tool that can empower people, strengthen communities and enact positive change. For example, this year we started working with the UN Refugee Agency as a corporate partner to donate solar power broadband connectivity and laptops to seven off-grid refugee settlements in Uganda. We are also partnering with the Global Partnership for Education to help address barriers to girls’ education in Kenya. By doing this, we can help Africa to empower growth, protect communities and unlock opportunities through better connectivity.

APT Satellite Power Pan, Director of Marketing

APT Satellite Power Pan, Director of Marketing

Thanks to the sky-rocketing development of the satellite broadband and mobility sector, APT Satellite is of the view that the satellite industry will soon recover from the Covid-19 epidemic. We particularly see how the wide use of HTS technology on GEO satellites has brought great competitive advantage, and even enabled satellites to compete with terrestrial offerings in some cases. For some applications that were thought not applicable for satellites, high-throughput satellites (HTS) proved their viability in recent years. As the satellite operator with the most HTS in Asia, we will see more revenue coming from them.

We have observed that the traditional linear sector may have slowed down with the rise in OTT services, but the great efficiency of broad satellite coverage still proves that traditional C-band and Ku-band satellite will offer unique value to DTH and cable headend distribution/contribution uses. This is especially true for our core markets in Asia, where the rainfade factor and fragmented lands and seas favour the use of traditional satellites.

The mobility sector is the future growth engine of this market, and our latest generation of satellites are all equipped with beams illuminating the busiest ocean and air routes, making sure that our customers can enjoy seamless connection no matter where they are.

In conclusion, APT Satellite is of the view that the industry will recover and is well poised to cope with future growth.

Hughes Network Systems, LLC Dan Losada, Vice President, International Division

Hughes Network Systems, LLC Dan Losada, Vice President, International Division

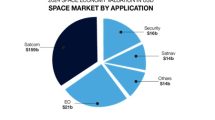

According to the Satellite Industry Association (SIA) annual State of the Industry report, the global space economy, including the satellite industry, grew in 2020 despite the pandemic. This aligns with what we saw at Hughes from March 2020, when traffic on our networks increased exponentially. With HughesNet customers working from home and taking classes online, instead of peaks of traffic in evenings and on weekends, we saw steady satellite internet usage with much of our network operating at full capacity.

Our enterprise customers also pivoted to virtual operations, putting additional demand on managed network services. For instance, retailers and restaurants turned to applications like online ordering, curbside pick-up (necessitating WiFi access) and third-party delivery (requiring app integrations) – all of which rely on network connectivity.

The pandemic illustrated the need for connectivity for everyone, and that is both the challenge and the opportunity. To meet that need in the coming years, we’ll need to innovate networks across the ecosystem that are multi-orbit, multi-service and use multi-transport technologies.

One clear area of growth for the industry is in LEO implementations. Connecting everyone, everywhere requires working across orbits, developing solutions that leverage the best of each constellation – for instance, GEO for capacity density and big data; LEO for global coverage and low latency.

The demand for broadband can only be met with multi-service networks that include GEO as part of the solution and the right ground technology to support different applications. With a ground system that is virtualised, cloud-enabled and software-defined, operators can allocate satellite capacity flexibly to serve different sectors (consumer, enterprise, mobility, etc).

Ultimately, the connected future depends on multi-transport technologies using every type of broadband. That may mean GEO to connect remote sites to a larger multi-transport network, such as at the 15,000 Hughes customer sites where satellite nodes are part of a managed SD-WAN implementation. Or that may mean using satellite to backhaul cellular network traffic, expanding mobile network reach to rural places.

In all, we are excited about the renewed global focus on the space industry and bullish on the opportunity ahead for the satellite industry, especially as we anticipate the launch of our next-generation JUPITER 3 satellite in the second half of 2022.

Access Hub Omkar Nikam, founder

Access Hub Omkar Nikam, founder

The annual growth of the satcom market can potentially cross $45bn by 2028, aligned with the full deployment of LEO satellite constellations. The pandemic has primarily impacted the upstream satellite production value chain, leading to a shortage of several components, including electronic chipsets. On the downstream side, however, things have escalated in terms of demand for high-speed connectivity. Several operators and service providers have recorded a boost in demand for broadband connectivity during the pandemic.

In a way, the pandemic helped accelerate the transition of broadcasting to broadband. The EMEA and Asia markets still remain the hotspot of satellite broadcasting, but the regions are also simultaneously experiencing a gradual increase in OTT content consumption. LEO operators will be turning the tables by capturing most of the consumer broadband and hybrid networks market, leading to the amplification of opportunities in the OTT via satellite market.

In the coming years, we can expect to observe and record a new wave of innovative applications. As LEO operators have kept a close watch on the broadband market, hybrid networks, mobility, consumer and enterprise are some of the important market segments that will provide significant opportunities to satellite service providers. We expect some regulatory and technology challenges to emerge as some LEO operators also plan to create multi-orbit connectivity (LEO, MEO and GEO), but this can be overcome with time, considering the scale of innovation that the industry recorded in the past decade.

AsiaSat Roger Tong, CEO

AsiaSat Roger Tong, CEO

There is no doubt that the global pandemic has affected economic activities across different sectors and world regions. In addition, the coming of the LEO satellite services, the rollout of 5G using portions of the C-band frequencies, and changing consumer behaviours are driving the market in directions that are hard to predict and isolate.

As Asia’s leading satellite operator, AsiaSat has kept pace with technological changes and strategic challenges by transforming our business and aligning our overall strategy and vision to address changing market needs, and meeting customer expectations in both the video and data sectors.

In the video market, to complement the existing satellite-based service offerings to our global broadcast customers, we have looked at more ways to distribute content, for example through terrestrial delivery mechanisms. The latest addition is our new broadcastgrade ‘One Click Go Live’ streaming service for delivering a full range of corporate, business and media events, whether for entertainment such as concerts and sports, or global meetings, business conferences, educational and corporate activities such as shareholder meetings and town halls.

In the data sector, particularly the mobility market where satellite can demonstrate its unique ability and value, consumers’ growing focus on individualism has boosted the demand for connectivity service. The recent launch of our new managed maritime broadband service SAILAS is to address the connectivity needs of all maritime verticals by providing highly flexible and competitive data service to enable maritime end users to enjoy cost-effective, secure and reliable connectivity at sea.

Asia is one of the world’s most diverse markets. With the convergence trend of video and data, our strategy is to stay relevant in this challenging business and adapt to the rapidly evolving market environment. Through vertical expansion to diversify our service offerings to complement our core satellite-based service, whether in areas of video, data or mobility services, we look to provide integrated end-to-end solutions that can fit into our clients’ businesses flexibly and cost-effectively.

Add Comment