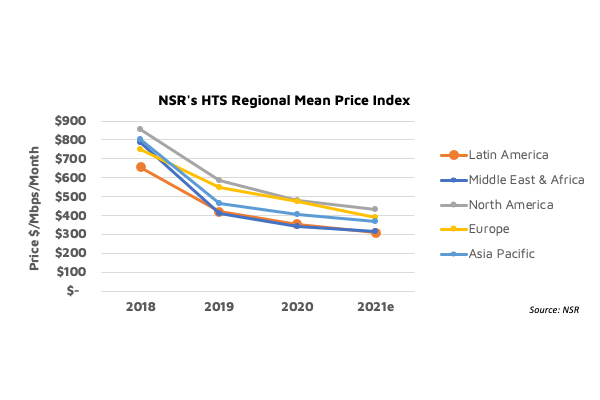

Stability in currency, politics, inflation and risk of default has had an outsized impact in regions of Africa and oil-dependent businesses. Satcom prices have seen large plummets and with COVID-19, the pressure on pricing is going to sustain, if not increase, according to NSR.

Stability in currency, politics, inflation and risk of default has had an outsized impact in regions of Africa and oil-dependent businesses. Satcom prices have seen large plummets and with COVID-19, the pressure on pricing is going to sustain, if not increase, according to NSR.

With 2020 representing a key transition phase, NSR analysed historical patterns of price discounting to ascertain what lies ahead. In the new report, NSR analysed how these strategies/factors have evolved and what it means for the Satcom business.

Contract Duration (Backlog Indicator): Contract durations have sharply decreased in the Enterprise, Backhaul and Consumer Broadband segments, with large HTS satellites, launched every year along with the anticipation of LEOs. Average Video Distribution contract duration shrunk to below three years in 2020, in contrast to Aero contracts that remain the longest in the industry. With more than 30-50% decline in contract duration over the past three years, the backlog has been severely affected, denting investor expectations on stock prices.

Capacity Amount (Bulk Leasing Indicator): Discounts for leasing higher amounts of capacity have gradually increased over the past 3 years, as operators look to lease the bulk of a satellite to an anchor customer. Bulk discounts on HTS satellites can be far steeper than FSS, owing to a larger reduction in the cost of sales metric. Video Distribution, DTH and Maritime were most impacted in 2019-20, while Aero and Backhaul witnessed large discounts in 2017-18 and 2018-19, respectively.

SLAs and Ground System Efficiency: Premium capacity demand for the enterprise FSS segment fell in the past 3 years, with a need for more bandwidth and acceptance of lower link reliability. While the Mobility FSS segment continues to provide differentiation on premium vs. cheap contracts, the video segment has seen a sharp preference for content over underlying TPE quality, thus ushering in lower prices. Meanwhile, increasing modem efficiencies across segments have given leeway to service providers to cut losses and provided EBITDA cushion to operators.

Supply Pressure (Competition and Retention): With increasing supply, fill rates have taken a large hit. As business models are largely based on data consumption today, supply has largely exceeded demand, except in segments like Aero. This has intensified regional competition, consequently resulting in heavy discounting. While new HTS supply directly impacts backhaul and broadband segments, stagnant demand in video has warranted steep customer retention discounts from operators in 2019-20.

Demand Elasticity (Market Addressability): The Industry has been packing more Hz per dollar right from building IPSTAR as first HTS satellite, to the ViaSat-1/Jupiter-1 breakthrough, to the upcoming ViaSat-3/Jupiter-3 class of satellites. As the cost of bandwidth drops, consumer business models have become more attractive, exponentially increasing the addressable market. Similar is the case for backhaul, transitioning from FSS to HTS, and to unlocking and enabling small cells today. Both pre-launch discounts and anticipation of elasticity have a large impact on service providers negotiating hard to close new business cases, a trend that has accelerated lately.

Demand Elasticity (Market Addressability): The Industry has been packing more Hz per dollar right from building IPSTAR as first HTS satellite, to the ViaSat-1/Jupiter-1 breakthrough, to the upcoming ViaSat-3/Jupiter-3 class of satellites. As the cost of bandwidth drops, consumer business models have become more attractive, exponentially increasing the addressable market. Similar is the case for backhaul, transitioning from FSS to HTS, and to unlocking and enabling small cells today. Both pre-launch discounts and anticipation of elasticity have a large impact on service providers negotiating hard to close new business cases, a trend that has accelerated lately.

External Factors: There are several external factors at play. OTT had an increased impact on DTH in 2019, while declining advertising has adversely impacted FTA. The impact of fibre is seen as less severe on the incumbent satellite broadband market (better bandwidth plans), although higher churn is witnessed in backhaul. Efficient ground systems remain a key to unlocking more bits per Hz and stabilising price. There is less pressure in mobility segments, which are largely satellite centric to connectivity. Consolidation of service providers in mobility increased pressure over operators during the past 3 years, though consolidation in the equipment layer is expected to hasten the pace of innovation and alleviate it.

It’s critical to understand discounts and premium pricing factors to dissect the right Satcom market dynamics. Operators must optimize their business cases to not be left behind. COVID-19 will play a crucial role in deciding the short to medium strategy for all players. While higher advertising on Pay-Tv and essential Gov/Mil communications will keep operators afloat, the downturn in mobility will largely have operators book losses. Higher bandwidth demand in data segments should ease off the supply pressure, while service providers will look to test the limits of the elasticity curve.

Add Comment