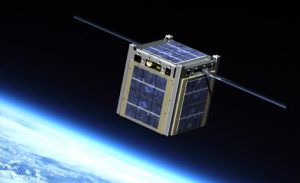

According to Euroconsult’s latest report, Prospects for the Small Satellite Market, significant expansion in terms of capabilities and demand is underway in the smallsat market. Over 6,200 smallsats are expected to be launched over the next ten years, a substantial augmentation over that of the previous decade (several mega constellations are now included within the scope of this report). The smallsat market from 2017-2026 will be driven by the roll-out of multiple constellations accounting for more than 70% of this total, mainly for commercial operators.

According to Euroconsult’s latest report, Prospects for the Small Satellite Market, significant expansion in terms of capabilities and demand is underway in the smallsat market. Over 6,200 smallsats are expected to be launched over the next ten years, a substantial augmentation over that of the previous decade (several mega constellations are now included within the scope of this report). The smallsat market from 2017-2026 will be driven by the roll-out of multiple constellations accounting for more than 70% of this total, mainly for commercial operators.

“The total market value of these smallsats could reach $30.1 billion in the next ten years, up from $8.9 billion over the previous decade,” said Maxime Puteaux, Senior Consultant at Euroconsult and editor of the report. “The smallsat market has quickly expanded over the last five years and will experience a sustained expansion in the future. Constellations’ demand is more cyclical with strong variations driven by deployment in batches whereas demand for single satellite missions is more stable. Improvements in performance also change the shape of the satellite; miniaturization is a continuous process which gives customers the choice between lighter satellites with the same capabilities or heavier, more powerful satellites. In the heaviest mass category, smallsats are now able to perform missions that in the past were only achievable by satellites heavier than 500kg.”

Smallsats cover a range of applications. In the last decade, the most predominant application area was “technology,” defined as a satellite designed to test future technologies and payloads or for educational purposes. In the future, this application area will be overtaken by the growth in EO and satcom units.

- Earth observation will increase significantly; over 1,100 satellites are anticipated through 2026. Four companies plan to launch more than 970 satellites during this period alone: Planet, DigitalGlobe’s Legion and Scout, Spire and BlackSky.

- Satellite communications broadband is expected to exhibit the strongest growth in terms of units launched, with nearly 3,100 from 2017 to 2026 (including OneWeb, SpaceX, and the Telesat Ka / V constellations). There are six constellations foreseen, however OneWeb and SpaceX make up the bulk of these units.

t

t

Of the total $16.5 billion manufacturing market value from 2017 to 2026, $3.7 billion is absorbed internally by in-house manufacturing; the remaining $12.8 billion is considered part of the open market. Over the period of the study (from 2007 to 2026), there is a clear divide in the typology of manufacturers of smallsats: In-house company and academia manufacturing rests in the realm of less than 50kg, while dedicated integrating companies comprise the realm of 50kg and higher. Considering the number of satellites that are being manufactured in-house (either through companies in-house, academia or space agencies) or are captive from domestic manufacturers where tenders are not open to foreign bidders, the market potential for third-party industry does not comprise the entire market value.

In the next decade, launch services are expected to generate $14.5 billion, a 76% increase over the previous decade. Launch revenues are increasing faster than manufacturing in relation to more satellite launches and reflect growing competition in a market which is not yet mature, with more diversified options for access to space to be available soon. Heavy and medium launchers remain attractive for constellations as a cost-effective deployment method or for piggy-back missions. New small or dedicated launchers will offer a premium ride but be a more costly alternative.

Add Comment