Space is emerging as the new frontier for private investors and individuals can get a slice of the multi-planetary action for as little as US $25,000. ‘Angel investors’, including a growing number from the Gulf, are now helping to finance out-of-this-world entrepreneurial projects in a race reminiscent of the early days of Internet and tech-start-up funding.

Space is emerging as the new frontier for private investors and individuals can get a slice of the multi-planetary action for as little as US $25,000. ‘Angel investors’, including a growing number from the Gulf, are now helping to finance out-of-this-world entrepreneurial projects in a race reminiscent of the early days of Internet and tech-start-up funding.

Getting in at the seed stage is vital to fuel an industry which Chad Anderson, CEO of Space Angels Network, which brings space start-ups together with investors via online dealing, says holds out enormous opportunity. “There’s a lot of business in space which is new,” he says, pointing out opportunities in reusable launch technology, small satellite constellations, private in-space habitats, lunar logistics, and asteroid mining. And, says Anderson, Gulf investors are lining up alongside US and European ‘angels’ with their eyes on the potential of orbital returns.

Speaking ahead of his planned January visit to the UAE capital, where he’ll join a panel at the Global Space Congress, Anderson says there are now hundreds of companies coming up in the space sphere and are looking to angel investors to finance projects and he said, “the Middle East has a role.”

Anderson will join a panel at the Global Space Congress, the region’s premier space event, which runs at The St. Regis Saadiyat Island Abu Dhabi on January 31 and February 1, to examine Financing Space. Addressing a global audience of over 600 space experts, including space agency leaders, C-suite space and aerospace executives, government ministers, top researchers and academics, the panel will share its insights on where space investment is coming from, how its return on investment can be calculated and its impact on the funding of R&D projects and innovative new space technologies.

And with a successful career at JP Morgan behind him, Anderson, who penned the first market assessments for commercial lunar services, a UK spaceport, and commercial spacesuits, will put forward the case for angel investment in an industry which is opening up for business.

“The UAE in particular is pushing its own space agenda and has a reputation for supporting innovation so we can expect interest coming from the Emirates,” he says. In nine years Anderson’s company has built a network of 230 angel members across 25 countries and facilitated capital flow to dozens of space start-ups. Angel investors are one route to leveraging the commercialization of space complementing government big ticket investment which, he says, will continue out of “nation building and defence interests.” Innovation prize funding will also have a role as will public-private partnerships. But angel investment, he says, will be the engine for entrepreneurial advancement of space opportunities and its gaining down-to-earth traction.

“Four years ago we averaged one deal per month for our members, today, we bring in two or three quality deals each month. Business is picking up on both the investor and entrepreneur sides of the equation,” he said.

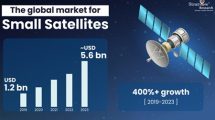

Anderson says three major trends – reduced launch costs, miniaturization of technology and standardization – are making the space sector accessible to startups for the first time.

“We are seeing more space business plans that resemble conventional business plans, which have all the fundamentals there – are customer focused, have structured, long-term business models and revenue generating strategies and that’s playing out well with investors,” he says. The success of concerns such as advanced rockets and spacecraft maker SpaceX and Spaceflight Inc. a pioneer of space accessibility has, says Anderson “improved investor perception” of real commercial opportunities from space. “There’s real excitement mounting, a real buzz around space much as when investment in the Internet took off. And because there has been investment from well-known players other mainstream investors are now interested in backing private space companies.”

Major forums, such as Abu Dhabi’s Global Space Congress, help put the commercial opportunities of space in the mainstream agenda, according to Anderson. “Education is a big piece of what we do, helping people to understand the real risks and opportunities in the sector and that’s why events like the congress are so important and I think the UAE Space Agency is serving the industry well by staging this. Investors can find the sector intimidating – it is ‘rocket science’ after all, but there’s quality business models in space that have a lot in common with good business models in other industries. We want to demystify the rocket science and break it down for people so they can understand what is really going on and what the real opportunities are.”

The Global Space Congress organisers say new financing models are a key issue up for debate at the event which is expected to help drive the multi-planetary agenda regionally and internationally. “Congress attendees will evaluate the biggest opportunities in the space sector and gain exposure to the world’s most vibrant and energetic new space programmes,” said Nick Webb, Managing Director, Streamline Marketing Group, which organises the event with the patronage of HH Sheikh Mohammed Bin Rashid Al Maktoum, Vice President of the UAE and Ruler of Dubai and in association with the UAE Space Agency.

Add Comment