When Michael Hollenbeck, CTO of Optisys, demonstrated the world’s largest 3D-printed antenna, he also unwittingly offered an insight into just how the satellite ground segment infrastructure is changing.

The 75cm-long, flat-panel slotted antenna was printed in metal as one continuous piece, and the ultra-large tile serves as the basis for a larger array in ground applications, although it can also be used in aerospace, sea and satellite applications. Made in just one print, the new product is both scalable to a considerable size and cheaper to produce than more traditional antennae requiring tens of parts from multiple vendors.

“This new capability is especially applicable for marine, ground and satellite antennas, which are all normally very big due to the distance their signal has to travel. Now these systems can enjoy better performance and have lighter weight options, at a much lower cost than traditional antenna technologies,” Optisys CEO Janos Opra stated a while ago, while emphasising the reduction in costs for customers.

Additive manufacturing is just one of several new technologies being pressed into use as satellite ground infrastructure finally begins to catch up to space segment developments. Long relegated to second place, ground segment technologies are now often developed alongside space solutions. Indeed, the sector may well be at a tipping point, thanks to the confluence of several different factors: a reinvigorated space race, a greater demand for connectivity across the maritime, in-flight, and consumer sectors, and a wave of cutting-edge technologies that can be leveraged to address these demands – if not quite yet at the scale or cost required.

Market research and consulting firm NSR estimates that cumulative revenues for the entire ground segment through to 2028 will total $145bn. The market will generate $14.4bn annually by 2028, the firm states in its recent report, Commercial Satellite Ground Segment, 4th Edition (CSGS4).

Pulling back for a big picture view, the overall global space economy was worth $366bn in 2019, a 1.7% increase over the previous year, the Satellite Industry Association (SIA) said in its 2020 state-of-the-industry report. The commercial satellite industry accounted for $271bn, or close to 75% of the world’s space business. Ground equipment accounts for 48% of this total, the SIA says.

Changing business models

The ground segment has therefore become a strategic network element for both operators and service providers, NSR says. The segment now offers a crucial competitive advantage thanks to developments such as changing form factors in the shape of cutting-edge flat panel and phased array antennas, sophisticated network management to cater to increased bandwidth demands, efficient MHz utilisation, complex traffic manipulation and open bottom-of-the-pyramid markets.

Perhaps the biggest general trend putting the ground segment at the forefront of innovation is the way the business model is changing, moving from the wholesale business model to providing end-to-end solutions, says Lluc Palerm-Serra, Senior Analyst at NSR.

“Satellite operators have realised the need to incorporate the ground segment into their data strategy, so you see them investing heavily on the ground. Earlier, they just thought about the satellite. Now, they think about the satellite together with the ground segment – and they’re designing both elements in parallel for an end-to-end solution.”

He offers the example of Viasat here. It’s Real-Time Earth satellite ground network is already becoming a reality; the launch of the Viasat-3 constellation (now delayed because of the coronavirus pandemic) is expected to connect groups that currently have limited or no internet access, among them billions of people on land, at sea and in the air with uniform coverage, and vastly improved speeds and data capacity.

The great rush to LEO

Simultaneously, the rush to develop low-Earth-orbit (LEO) and medium-Earth-orbit (MEO) satellites could see around 50,000 active satellites orbit overhead within ten years, up from about 2,500 presently, according to McKinsey estimates.

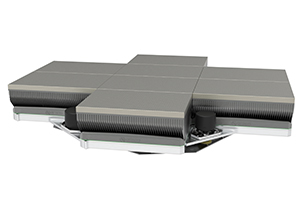

Against the development of LEO constellations, flat-panel antennas (FPAs), in particular, electronically steerable antennas (ESAs), are expected to soon be a necessity for satcom, according to NSR. FPAs’ higher price points have seen them restricted to the premium end of a market largely serviced by traditionally parabolic antennas. However, the parabolic dish is poorly suited to LEO constellations, which will have numerous satellites all rapidly crossing a ground receiver’s field of view at the same time.

ESAs can track and scan large numbers of satellites quickly and deliver multiple capacity types from multiple orbits – without physical movement of their own. This flexibility will see FPAs assume greater market importance as the trade and end consumer look for next-generation solutions.

“The biggest factor driving technological development is moving satellites into low-Earth orbit so that everything becomes mobile. Existing user terminal technology is not effective in optimising the value of the LEO satellite constellations. The combination of more, higher powered, and closer to Earth satellites will drive innovation much more exponentially,” explains David Harrower, Senior Vice President of Global Sales at Kymeta.

“The inherent attributes of some flat-panel antennas allow for deployment on platforms that satellite has never been able to reach before, which is opening new markets for mobile connectivity and helping narrow the gap in the digital divide.”

In August, the antenna technologies’ developer announced a beta trial programme of the Kymeta u8 terminal with select partners and customers globally. A full launch of the Kymeta u8 ESA is planned for Q4 of 2020. The u8 will support global land mobility, covering the full Ku-band with improved efficiency, with its integrated satellite and cellular modems offering seamless hybrid satellite/cellular connectivity over a multi-WAN configuration.

Along with the new terminal, Kymeta is also beta trialling its new Kymeta Connect suite of services offerings – “making connectivity as easy as buying a wireless plan”, it said in a statement. Together, the two create a complete turnkey solution for public safety, DOD/MOD, enterprise, and other markets requiring always-on, on-the-go communications.

Kymeta recently also announced securing approximately $85m in financing led by Bill Gates with members of the leadership team personally investing approximately $1m led by Executive Chairman, Doug Hutcheson. The funds will be used to accelerate new product development and commercialisation for satellite and cellular communications globally. Its goal, according to Hutcheson, is to produce tens of thousands of products by 2023 – provided, that it can build a production line to perform at that scale.

Don’t write off GEO just yet

But while the size of those deals and development of LEO players in the commercial sector continue to grab headlines, GEO operators continue to invest in the HTS services already available today, says Jerry Adams General Manager, SATCOM Products Division at L3Harris Technologies.

“This, in turn, is driving ground segment efforts to develop new terminals — with L3Harris leading the way — able to take advantage of increased coverage, higher power and advanced capabilities offered by next-generation GEO for bandwidth-intensive applications,” he says.

“CONOPS are more demanding,” Adams adds. “The appetite for bandwidth continues to grow as CONOPS transform from the large-scale deployments of the past to smaller, more complex missions that demand deployment agility coupled with high data throughput. Capabilities like VoIP, full-motion video and near-instant communications need to be supported with reliability, and above all, portability. This is where VSATs play a critical role in developing and maintaining complete situational awareness.

“Higher-power HTS GEO allows smaller aperture terminals the ability to capture the same or higher amounts of throughput as much larger terminals.”

The rising importance of data across multiple points in recent years has seen corporations around the world rushing to embrace this new opportunity. As NSR’s Palerm-Serra notes: “The economic driver for the industry is moving from video to data. And for data, the ground segment is much more important, so we’re seeing an explosion in data requirements.”

Where does 5G fit in?

That data requirement is part of a larger trend occasioned by the advent of Fourth Industrial Revolution technologies such as artificial intelligence, 3D printing, cloud computing and blockchain. As the consultancy Deloitte points out, these are being combined for a compounded effect to drive transformational change across the industry. Yet, all of them rely on the advanced connectivity provided by fifth-generation cellular technology (5G).

“The satellite industry must not underestimate the transformative power of 5G,” Palerm-Serra says.

The technology offers a new way to conceive networks and service delivery, he adds, opening a window of opportunity to make satcom seamlessly integrable with terrestrial technologies. “5G-fortified networks are creating a lot of pressure on the ground segment, in the sense that the satellite industry needs to be interoperable with 5G, and the capacity for that is on the ground side. So, we see a lot of vendors working at making satellites 5G-ready because it touches on all the different verticals. 5G is a totally new way to conceive network architecture, so all the major trends – software-defined networks, network orchestration, flexible satellites, mobility – are all related to 5G to some extent. 5G will create a new framework which will bring all these technologies under the same umbrella,” he adds.

But there’s that cost question

For now, however, cost remains a major restriction to technological advances in the ground segment – more so in a market where the coronavirus has dented demand considerably. As Optisys’ Janos explains, the form factors and the use case of any ground system equipment depends entirely on the customers’ budget.

“Parabolic antennas offer the best cost and are available for thousands of dollars. They are the most cost-effective and are very high performance, but you do have a larger structure,” he points out. “FPAs are the most expensive – hundreds of thousands of dollars – but are also very smart. On the other hand, a parabolic can take 40-50 watts, while a phased array may perform similarly but give you kilowatts of power. So, there will always be a trade-off.”

Add Comment