What’s the story behind SWISSto12?

It’s a business I started 12 years ago as a spinoff from EPFL, the local university here in Lausanne. Our initial developments were around how to use 3D printing to efficiently build RF products. Initially, our focus was on antenna products and signal-routing components for wireless communication applications, particularly satellite communications. This innovative approach disrupted the conventional method of machining and assembling machine parts. By utilising 3D printing, we could replace multiple components with a single piece.

You can then free up the design space of the RF products and work towards enhanced performance. So, in the context of building a telecommunications satellite, it offered greater flexibility for advanced payloads and improved manufacturability. 3D printing enables improved performance while adhering to size, weight, and cost constraints.

How did you progress towards developing small GEO satellites?

Over time, our role as a product manufacturer evolved, and we got more involved in a higher level of integrated assembly and subsystem projects, in both space and ground operations, including diverse platforms like user terminals. And we took a keen interest in satellite systems and the market there.

We discovered that there’s a really interesting opportunity in the GEO market, because it’s been the historic sector that gave birth to satellite communications. It’s a well-established segment with an excellent business case but it’s transitioning from a broadcast-dominated business model to a broadband-dominated business model and that has created some challenges for operators. The two markets don’t work in the same time scale and typically, with broadcast markets, there’s longer-term visibility on the customer base for a satellite operator than there is in the broadband segment. The latter has made it harder for satellite operators to predict where the market will go long term and that complicates investment decisions. One way to go around this problem is to make increasingly flexible satellites that also have digital signal processing capabilities onboard.

Another way is to make satellites smaller, so they cost less and enable you to take a more incremental approach towards investing in satellites. This is how we came up with the idea of a small GEO satellite and that concept gave birth to HummingSat. It gives a satellite operator the opportunity to buy much smaller assets, which cost less but which preserve a good ratio of value for money if you compare the amount of transponders or the throughputs that satellites can achieve as compared to a larger platform.

These small GEOs sats are not there to replace the large platforms because if you look at what is the best way of creating economies of scale, the large platform is still the best metric out there and there are very good market segments for these large platforms. But the distinctive features of small GEO satellites provide opportunities for secure connectivity in small and medium-sized countries. All these business cases today are very difficult to address with larger geostationary satellites, which often leads to an investment not being made. Whereas if you can offer a smaller-sized GEO asset out there, it makes such investments feasible, thereby expanding the applications and reach of GEO satellites beyond their current scope.

Can a small GEO sat complement an existing big GEO satellite or does it operate entirely on its own?

Can a small GEO sat complement an existing big GEO satellite or does it operate entirely on its own?

It can. Of course, you need to organise all the co-location logistics and frequency coordination and aspects like that but fundamentally, it allows you to incrementally enhance capacity on a position that is already occupied by a large spacecraft and is perhaps full. If the operator wants to add some capacity to that orbital position but doesn’t want to double the capacity but just make a more measured investment increment, the small GEO sat offers that opportunity.

Would the reliability and the stability be the same for a small GEO sat and what cost reductions are we talking about here?

Okay, let’s tackle reliability first and the way these satellites are designed and architected. HummingSat is a significantly smaller satellite, so it’s about a tonne or less and about 1.5 cubic metres. So, it’s several times smaller than a traditional satellite, maybe five times smaller in mass and probably more than 10 times smaller in volume than a large satellite.

We do have a measured approach to architecting the systems because it is a GEO environment, which is often very harsh. We’re designing for 15-year-long missions. Having established that these are long missions, we cannot take shortcuts on reliability and quality, and have to work towards space standards. So, we actually make a lot of products and subsystems that have GEO flight heritage.

We have designed a system that is scaled down in terms of size, but we use a lot of suppliers, products, and a lot of flight heritage in our design to meet the reliability figures that are very similar to a larger legacy spacecraft that’s out there. So, there’s no fundamental change in terms of reliability for the HummingSat.

The lifespan is pretty much the same. We innovate on payloads. So, our core RF product USP really is important to enable us to put more payload in the small satellites, which allows us to increase the value for money of the small spacecraft for our customers.

But the products that we use and those that are relying on 3D printing technology are products that have extensive flight heritage today in GEO and larger spacecrafts.

In terms of size, it appears to be similar to the MEO range. So how would you differentiate between the two?

First, the design approach is very different for a 15-year GEO mission even if the size is small. You have a very different engineering and reliability posture than if you design a LEO or MEO satellite that has a shorter life span.

Fundamentally, we design towards higher reliability standards for the specifics of our GEO missions.

We already have direct access to established markets and that sets us apart. While LEO markets are evolving, small GEO satellites leverage existing demand and infrastructure.

For small GEO sats, you’re not talking constellations?

Not in the LEO sense. But with the Inmarsat 8 programme announcement that we recently made, for instance, Inmarsat has procured three satellites from us. So, one could call this a mini constellation in GEO to cover the entire earth with some very important services and their L band safety services, space-based augmentation services and those applications that require global coverage.

3D printing is what provided you with the inspiration to go down this road?

That was the initial spark. 3D printing allowed us to develop a unique and proprietary technology that gives us a big advantage in building cost-efficient RF products that are compact but high-performance solutions. It has enabled us to build efficient RF payloads and helped us build HummingSats and enabled us to enjoy commercial success as a prime satellite contractor.

Do you have any statistics on the GEO market that favour what you are doing?

There has been a decline in orders in GEO since 2015. It went from something north of 20 orders a year to around 10 to 15 orders per year for the last five to seven years. And this has mostly been prompted by this transition from broadcast to broadband, which has introduced some uncertainty in the markets. Added to that, Leo constellations offer a lot of promises and operators are waiting to see how they develop. Over the years, however, less investments have been made in GEO satellites. A lot of Geo spacecraft are reaching the end of their lives at a higher pace than if investments had been made more regularly. In fact, a third of the GEO spacecrafts out there today are more than 10 to 11 years old. This is typically a class of spacecraft that is entering into a critical phase, where if you don’t initiate a procurement now, which always takes a few years to build and launch, then there’s an increasing risk that the follow-on satellites will not arrive on time to meet the end of life of the existing satellite.

We’re talking about something in the order of a hundred satellites that are in that condition now. In the coming years, some of them will need to be replaced while some may be discontinued because the business cases they were associated with are no longer relevant, but it’s nonetheless significant.

Ageing satellites will become a concern because a lot of them support critical services that need to be continued. So, there is going to be continued interest in GEO for that reason. And because there’s an increase in demand in GEO, specifically for broadband services, that also needs to be addressed.

I think in the class of larger satellites, the software-defined satellites of the main legacy manufacturers have shown that there is a solution to introduce more flexibility in GEO satellites and to make them more adaptable to changes in market conditions in the future.

In parallel to that, small GEO sats address those business cases that are difficult to address with larger spacecraft.

When is HummingSat scheduled to launch?

By 2026, the first of our HummingSats will be in orbit, delivering services to billions of people. The second mission on Inmarsat 8 combines L band safety services. So, in continuation of the safety services that Inmarsat already provides today, there will be opportunity to expand into other types of safety services with these payloads and adjacent L band services that enable them.

And then, the second important service that will be distributed through the Inmarsat 8 satellites is a space-based augmentation transponder, which is present on all three satellites and provides the ability to increase the precision of GPS positioning signals for users down to as little as 10 cm.

Typically, how many small sats would you require to do something that a Big Geo sat can do and what cost reductions are we talking about?

It really depends on the use case but I would reckon three to five. So if that ratio is preserved, it would be three to five times cheaper as well, and that’s very important. Because when the operator looks at the business case, the bottom line is going to be the CAPEX investment into the satellite. What’re the number of transponders it provides and what’s the lifetime and then there’s a simple calculation of RF.

For this, we need to come into a similar ballpark as large spacecrafts to be able to create a real business for small GEO sats, which is what we’ve done through the first programmes we’ve announced. So, you are making incremental investments rather than huge investments at one go.

What are specific trends you are seeing in the market?

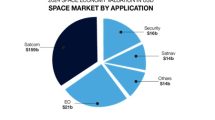

Broadband, in general, is a very favourable context because there are some demands irrespective of how you distribute broadband connectivity specifically for satellites. There’s still a lot of growth and mobility applications. So there are a lot of maritime and aero business cases emerging as well as direct-to-home services, enterprise services and government services. They’re all growing. There are major trends to try and integrate satellite networks into 5G networks, which means it makes it easier to make them interoperable with ground infrastructure.

What are some of the challenges that small startups like you typically face?

We’ve managed to have a very successful funding journey with predominantly Swiss and European investors who have backed us very solidly. I think in space, the main challenge is it takes time to get to a product that is deployed operationally that proves a real business case.

We’ve been in business for 12 years and we’ve taken an incremental approach starting with products, then going into subsystems, then going to a spacecraft. And we are still servicing today very successful businesses with many customers who buy our products and subsystems.

We do support other satellite manufacturers or aerospace integrators. But it’s a hard journey. It’s a lot of proof points, a lot of technical proof points to score, a lot of flight heritage and validation to accumulate to build the momentum. But if you develop a good product and if you deliver, then positive results come with it.

Essentially, you need the ability to execute and the ability to fund it from the start to the finish.

What’s next for you?

Our immediate focus is on delivering ongoing programmes and expanding HummingSat’s user base. We plan to enhance payloads for increased flexibility and incorporate digital signal processing capabilities. Assisting government users in adopting small GEO satellites is pivotal for market expansion. Swissto12 remains committed to innovation and improvement, and driving the potential of small GEO satellites.

Add Comment