The satellite industry is likely to see an explosion of services-driven revenue to the tune of a cumulative $1.2tn by 2031, with the share of data applications jumping from 15% of total market revenues to a remarkable 42% by 2031, according to research published by Euroconsult.

The satellite industry is likely to see an explosion of services-driven revenue to the tune of a cumulative $1.2tn by 2031, with the share of data applications jumping from 15% of total market revenues to a remarkable 42% by 2031, according to research published by Euroconsult.

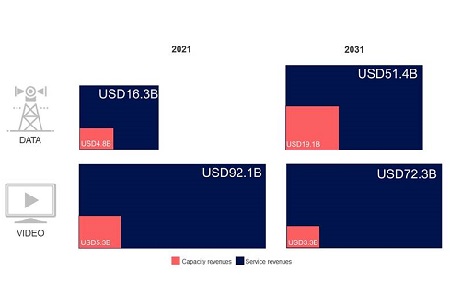

The falling average revenue per user (ARPU) and a competitive market have been the main drivers for changes in strategies, with operators pushed to look for extra revenues to avoid the commodity price trap. Their sights have been increasingly set on a new revenue stream – Services – which will grow from $108bnto $124bn in the space of ten years, with all the growth coming from data services.

The shift towards data-driven revenue streams can also be seen in the downward trend of video revenues, with the projected loss of 26m direct-to-home (DTH) subscribers and 8,500 satellite TV channels by 2031. Changes in viewing habits will contribute to the growing shift from linear viewing to Over-the-Top (OTT) services that will negatively impact the satellite video market in coming years.

The firm also predicts that the Satcom industry is on the springboard of a period of accelerated change created by the introduction of disruptive Non-Geostationary Orbit Satellites (NGSOs). The rapidly growing importance of NGSO in connectivity markets is heavily impacting the FSS industry, with an increasing number of players looking at a multi-orbit strategy to expand their business, as highlighted by Eutelsat’s recently announced merger with OneWeb, and the endeavours of several FSS operators to create a European NGSO constellation.

In the newest edition of its flagship ‘Satellite Connectivity and Video Market’ report, Euroconsult forecasts substantial growth in capacity supply to more than 97 Terabytes per second within the next five years, an added supply accounted for up to 94% by NGSOs. Capacity demand is also expected to be multiplied by a factor of 13, with a resulting market expansion boosting capacity revenues from $10.2b in 2021 to $22.4b in 2031, despite falling capacity prices.

Dimitri Buchs, Managing Consultant at Euroconsult, said: “In recent years, the take-or-pay model has become less frequent in the satellite industry as SPs/broadcasters have focused on lowering the risk when leasing satellite capacity.”

He continued: “This has led to the growing popularity of the pay-as-you-go model (where the risk is shared with the satellite operator). Whereas pay-as-you-go was mostly used in data segments, it has become more apparent in the video segment in recent years, notably for new players entering the market. Consequently, satellite operators’ backlogs have decreased in recent years.”

However, Covid-19 and the war in Ukraine have not spared the FSS industry, with supply chain issues due to microprocessor shortages and manufacturing bottlenecks leading to a significant number of satellites being delayed. The global inflation crisis has also pushed up satellite prices, most visibly impacting NGSO constellations like Telesat’s Lightspeed, which was forced to downsize.

Despite these short-term setbacks, the industry is expected to have a capacity revenue growth of 5% year-over-year in 2022, with the next launches of new constellations and large satellites in coming years being likely to kick off the period of growth by opening the floodgates of new capacity.

Add Comment