The latest update of Satellites to be built and launched released by Euroconsult forecasts a fourfold growth in the number of satellites driven by commercial constellations.

The latest update of Satellites to be built and launched released by Euroconsult forecasts a fourfold growth in the number of satellites driven by commercial constellations.

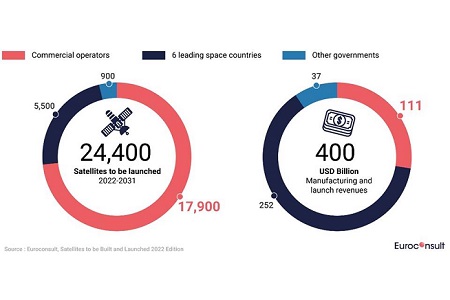

The market intelligence report, now in its 25th edition, anticipates over 2,500 satellites to be launched on average every year – or seven satellites a day totalling three tons of mass – over 2022-2031. Civil government and defence customers will remain legacy customers, holding the largest market value of $29bn every year with three-quarters of the demand in manufacturing and launch. The six leading space-faring governments or organisations alone (US, China, Russia, Japan, India and European governments, EU and ESA) will account for two third of the demand in value.

In terms of satellite numbers, NGSO constellations remain the largest market driver, as 83% of all satellites to be launched over 2022-2031 are expected to be part of constellations, though only accounting for 30% of the manufacturing and launch value.

Commercial demand will experience a novel feat as emerging NGSO constellation broadband operators will account for half of the commercial demand in manufacturing and launch value at $5.3bn yearly average, whilst GEO comsat will average $3.2bn. Euroconsult forecast a yearly average of 13 orders by 2031, reflecting eroding broadcasting business and a shift towards broadband business ramping up and not yet offsetting the previous one.

Satellite markets are no stranger to macro-economic uncertainty due to the war in Ukraine, the Covid pandemic, disrupted supply chains, high inflation and central bank monetary policy changes. The satellite industry is currently facing significant changes as satellite demand are becoming increasingly concentrated towards a handful of NGSO broadband players, while the market value continues to remain evenly distributed across players and orbits. Though largely unprofitable to date, these constellations put high stress on current supply capabilities and challenge vendors’ addressability through their vertical integration.

Commenting on the findings of the report, Maxime Puteaux, Principal advisor at Euroconsult and editor of the report said: “Increasing concentrated demands for satellites by a small number of new customers with high pressure on their cost structure will also put vendors’ margins under pressure. We have been monitoring satellite ‘mega factories’ and noticed they are emerging ten times faster than the projected demand. As we expect the 20 legacy vendors to retain at least 40% of the future demand in value, manufacturing oversupply is real and sustainability is at risk.”

The 9,100 Tonnes to be launched by 2031 will be lifted by a diversity of access to space suppliers ranging from micro to super heavy launchers. Despite the upcoming abundant launch supply forecasted towards the end of the decade, satellite operators are currently experiencing a shortage of launch options due to multiple factors that put their deployment schedule at risk in the short term.

Add Comment